Canalys: Apple and Samsung See Growth in Shrinking N.A. Smartphone Market

24 AUGUST 2022 - The June-quarter was a rough quarter for smartphones in North America - Apple and Samsung not included. Over halfway through the third-quarter, market tracker Canalys is out with numbers for the second-quarter of 2022.

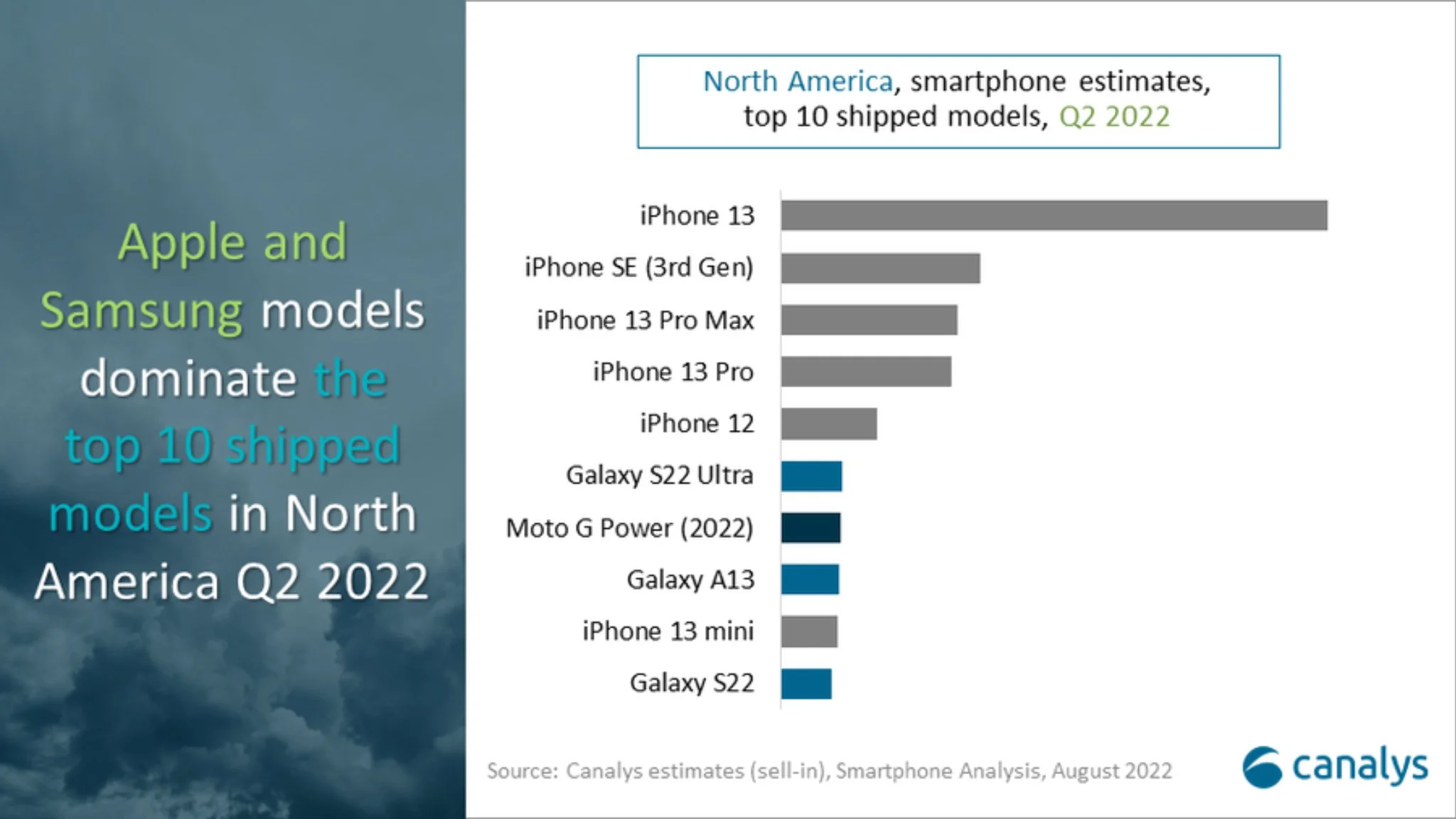

“Apple and Samsung models dominate the top 10 shipped models in North America in Q2 2022” - so says the wording on a Canalys chart. I feel like that’s being really generous to Samsung though. Six of the top-ten phones on the list are iPhones, while only three bear a Samsung logo. The last name on the list (above one iPhone and two Samsung phones) is Motorola. Apple ended the quarter with 52% of the June-quarter smartphone shipments in the U.S. That was followed by Samsung’s 26%, Motorola’s 9%, TCL’s 5%, Google’s 2%, and a tepid mass of others making up 6% of the shipments. With numbers like that, I’d have captioned the chart, “Apple dominates, Samsung’s a distant though respectable second, and who let Motorola in?”

As for what went wrong - do you really need to ask? According to one analyst with Canalys:

A combination of high inflation, decreasing consumer confidence, and an economic slowdown is shrinking demand in North America, which was previously the world's most resilient market. Vendors are responding quickly to falling demand and are focused on reducing the risk of oversupply as they prepare for new launches in the second half of 2022.

Where the firm sees smartphone strength in North America is at the bottom of the price ladder and at the top. Indications are that phones under $250 are selling well, as are phones over $600. Meanwhile, Mister-in-between’s getting squeezed. Even iPhone SE (starting price $429) underperformed Canalys expectations, seeing well under half the shipments of first-place iPhone 13. That said, the SE was the second best in North America by the firm’s reckoning, though iPhone 13 Pro Max and iPhone 13 Pro each saw nearly as many shipments as their more budget conscious cousin.